Amazon COGS FAQ

To include COGS in Amazon, you need to use the Cost per Item feature. This feature will accurately track your costs as long as you are updating it when there are changes. Additionally, you need to calculate COGS for tax purposes. To do this, you need to use the formula: COGS = Beginning Inventory + Purchases - Ending Inventory. You also need to account for any fluctuations in cost per item, such as varying supplier costs or multiple shipments throughout the year. Finally, you must perform an end-of-the-year inventory count to get an accurate value of your ending inventory. By accounting for these factors, you can accurately include COGS in Amazon and accurately itemize COGS on your Amazon Schedule C report.

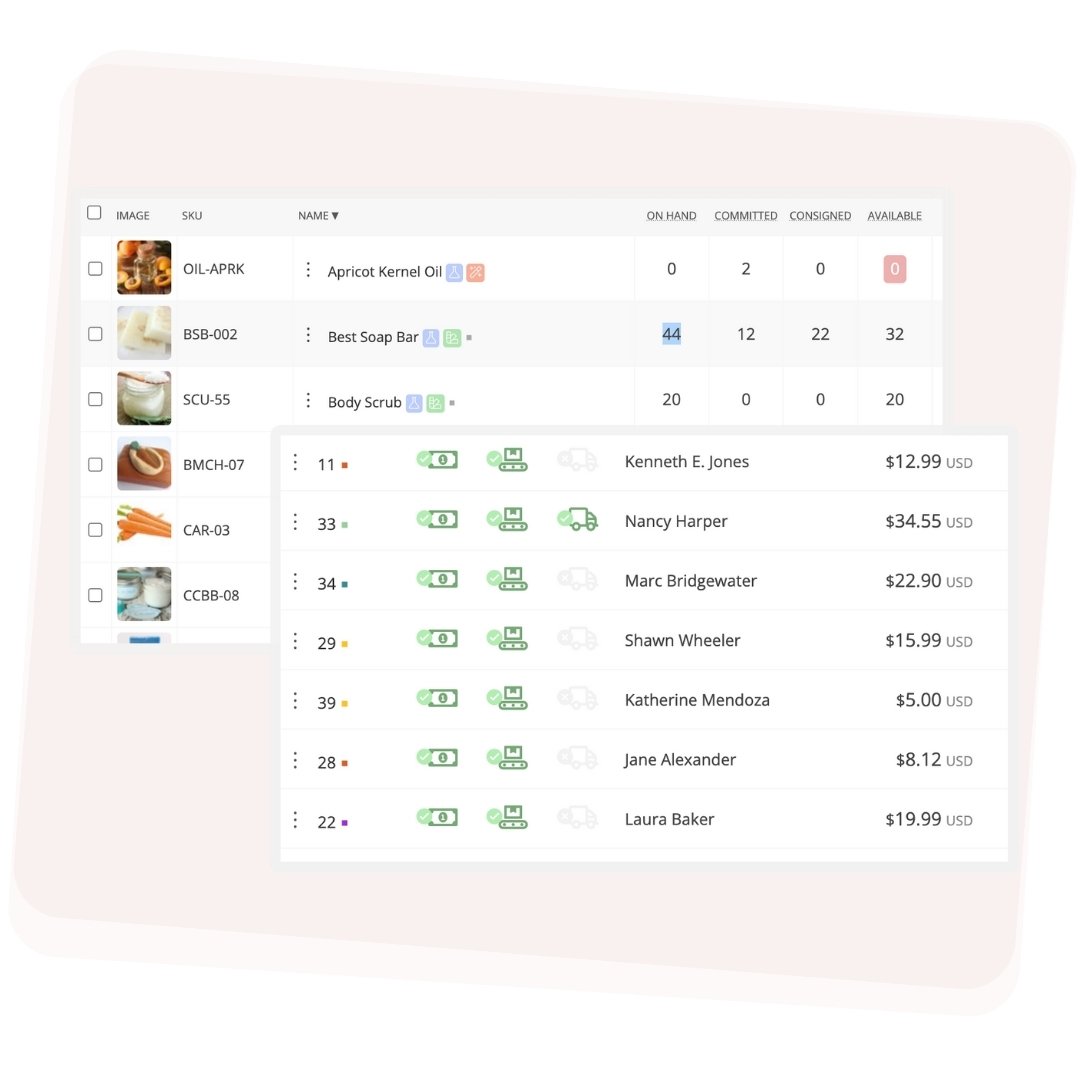

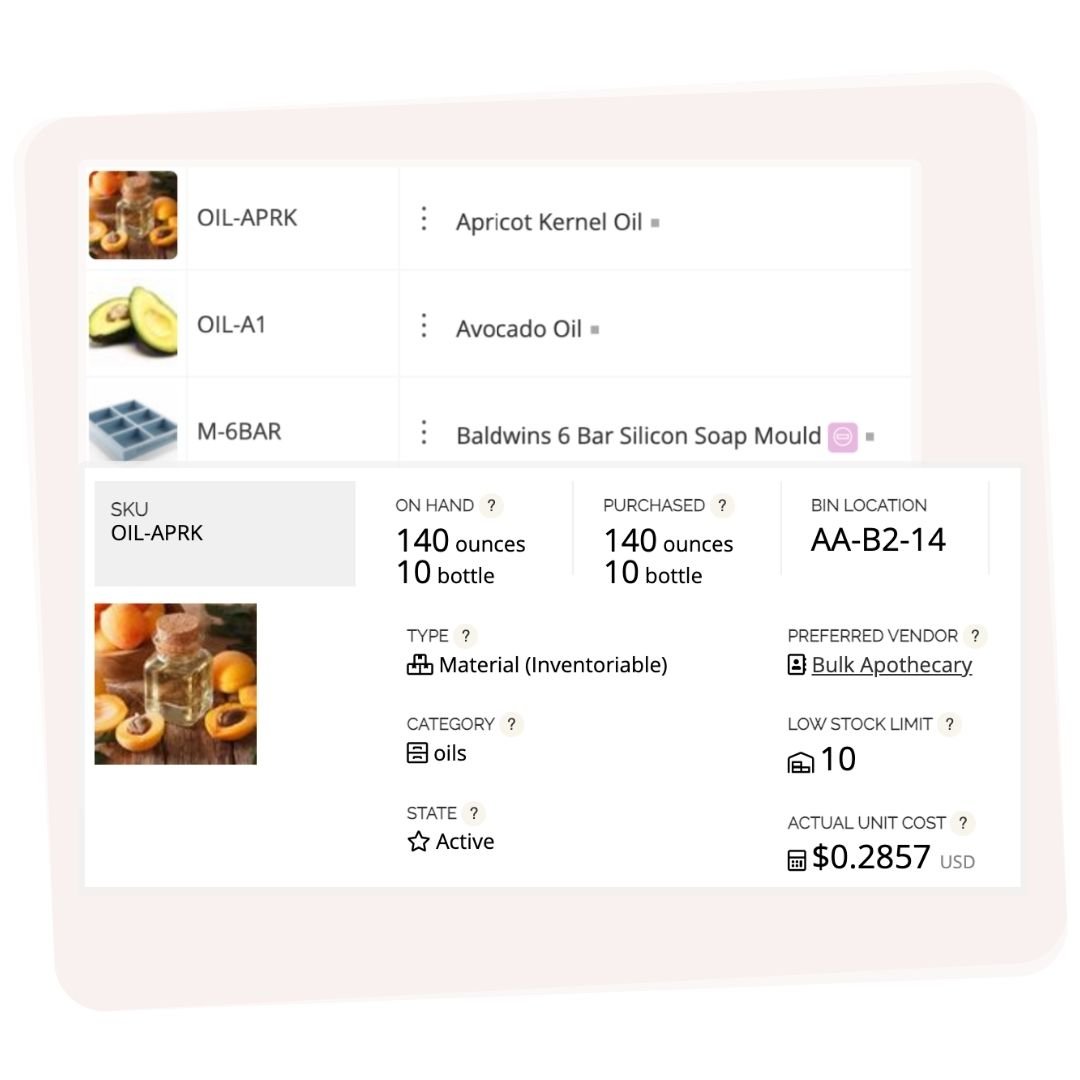

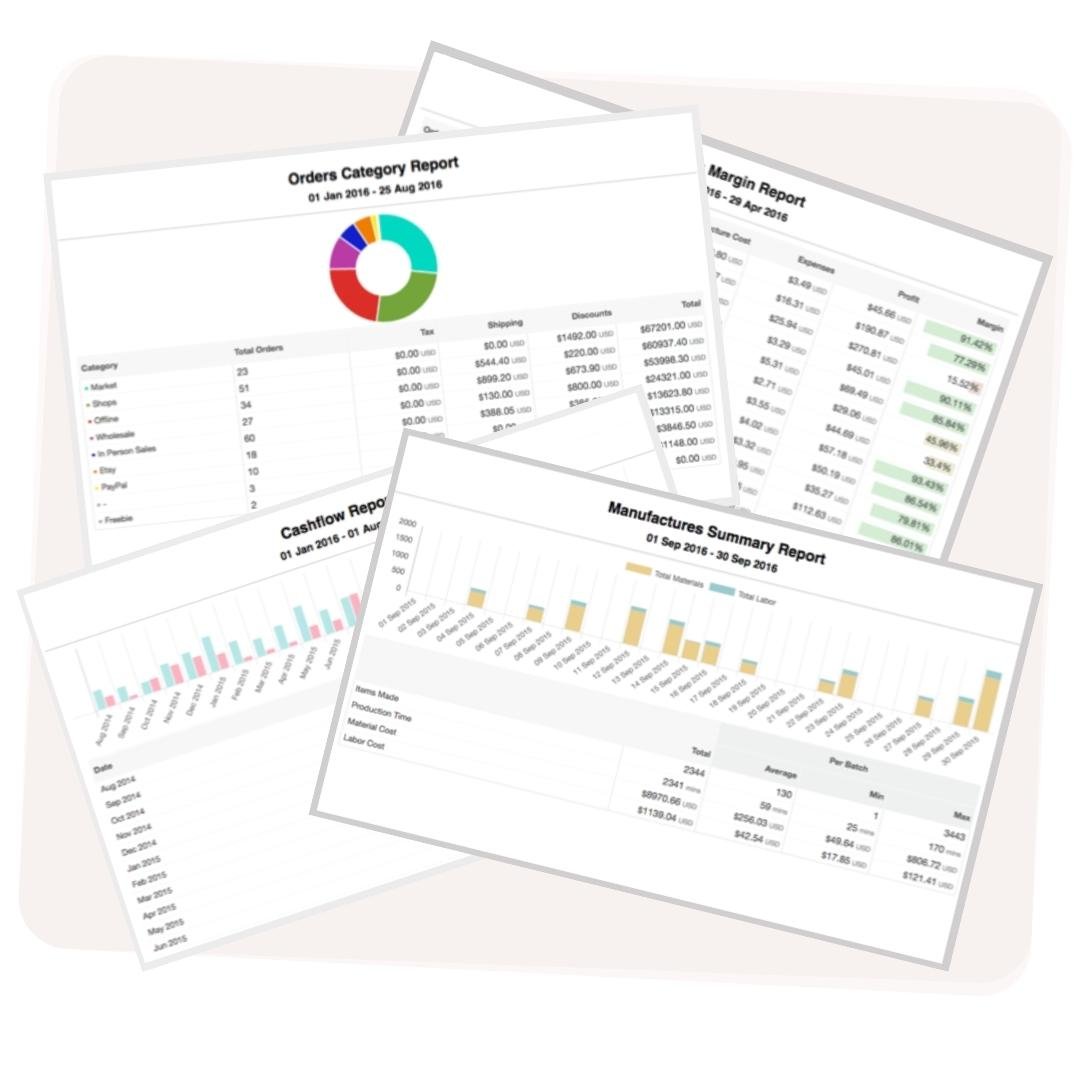

Craftybase is an app designed to help Amazon sellers accurately track their COGS. It allows users to enter purchase orders, sales records, and inventory levels into the app so that it can automatically calculate accurate COGS figures. The app also provides reporting tools for users to view their expenses and profits more clearly, giving them a better understanding of their business. Additionally, the app can track inventory levels in real-time, helping users stay on top of their stock levels and making sure they don't end up with too much or too little inventory. This helps keep their costs low and their profits high. With Craftybase, Amazon sellers can easily manage their COGS accurately and efficiently.

The COGS report in Amazon can be found under the ‘Reports’ tab. From there, select ‘COGS’ from the left hand menu and a summary of your Cost of Goods Sold will appear. This report is an overview of your COGS for the current period, showing you how much you have spent on inventory for the period, and how much you have sold. This report is updated automatically when new orders are placed or payments are taken, based on the costs you have entered in per item. This way of calculating COGS isn't as accurate as using a dedicated app such as Craftybase, but it still provides helpful insights into your business.