Schedule C: Your Easy Step By Step Instruction Guide

We show you how to complete and file your Schedule C form (1040) using simple step by step instructions.

The Schedule C is an IRS form that most self-employed DTC sellers must complete annually.

Essentially, the information you provide in this form is used by the tax man to determine how much money you made from your business, and how much you can claim on deductions (the expenses you have made to run your business).

It can understandably look daunting if you haven’t filled out a Schedule C before! The IRS provides 18 pages of accompanying documentation which can be really helpful for the finer details; however, it can still be quite challenging to interpret exactly what you need to do.

Need to get your raw material and product inventory under control?

Try Craftybase - the inventory and manufacturing solution for DTC sellers. Track raw materials and product stock levels (in real time!), COGS, shop floor assignment and much more.

It's your new production central.

To get you started, we’ve provided a line-by-line summary of what each section in the Schedule C means, so you have the confidence to complete this filing with ease.

Need some Schedule C info fast? Jump to a section in our guide:

- What is the Schedule C?

- Where do I download the Schedule C form?

- Business Details

- Part I: Income

- Part II: Expenses

- Part III: Cost of Goods Sold (COGS)

- Part IV: Information on your Vehicle

- Part V – Other Expenses

- How do I submit my Schedule C?

- Schedule C Software

What is the Schedule C?

A Schedule C is a form that US-based sole proprietor businesses need to complete to report to the IRS the amount of money they made or lost that year.

The form’s instructions provide guidance on calculating taxable profit or loss, taking into account income and expenses, as well as deductions. It is important to note that there are also other forms required for self-employment taxes, such as Form 1040-ES and Schedule SE.

To be formal about things, the full name of this form is Form 1040 Schedule C: Profit or Loss From Business (Sole Proprietorship).

Where do I download the Schedule C form?

The first thing you will need to do is download the correct form. It is available directly from the IRS website here:

IRS: SCHEDULE C Profit or Loss From Business →

Tip: The Schedule C form is updated each year, so you’ll want to ensure you have the correct one before completing it.

What does the Schedule C form look like?

The Schedule C form itself is only in itself 2 pages long, however it does have quite a lot of fields that you need to fill out.

The IRS also provides an additional 18 pages, give or take, of accompanying documentation which can be really helpful for the finer details. Being produced by the IRS, this documentation can quickly overwhelm as it is swimming with some pretty heavy tax jargon.

To get you started with your Schedule C, we will walk you through each section, line by line, so you know exactly how to complete this form.

A quick disclaimer before we begin the big Schedule C tour: please note that laws and regulations do tend to change frequently. This information is for educational and informational purposes only and should not be construed as legal advice. Please consult an expert in your local area with specific questions or concerns.

Let’s dive in!

Business Details

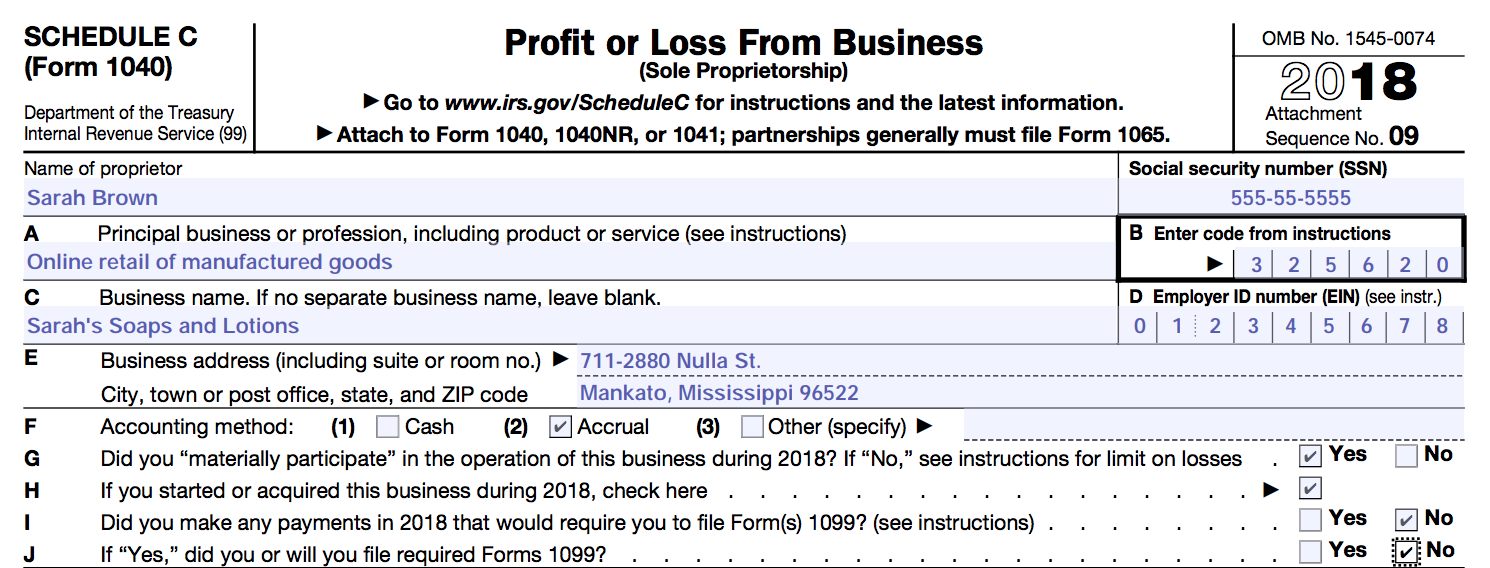

The very first part of the form (lines A through to J) is mainly to help the IRS identify you and your business. Most of this part is fairly self-explanatory, apart from some slightly hairy questions about NAICS, EIN numbers, and accounting methods that we will cover in detail below. Ready? Let’s Go!

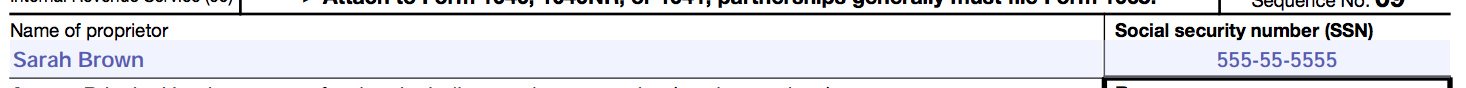

The first line you’ll need to complete is the Name of proprietor. This is your personal name, not your business name (as this will be asked for later in the form). You’ll also want to enter your Social Security Number (SSN) in the field to the right.

The next line (A Principal business or profession, including product or service) is to provide details about your business type.

If you make your own products and sell at least some of them online, this will most likely be: Online retail of manufactured goods.

To the right of this section, is a space (B Enter code from instructions) where you’ll need to enter the NAICS code that best matches your business activities. There is a list of Principal Business or Professional Activity Codes in p17 of the Schedule C form for you to choose from.

As the codes cover all sorts of business activities, it can take some time to wade through this list. To make this easier, we’ve made you a handy summarised list of the most common NAICS codes for small manufacturers.

This next one should hopefully be a little less taxing: you’ll want to enter your business name into the field called C Business Name.

You should leave this blank if you don’t use a business name.

The field to the right of the business name is for your EIN (D Employer ID number (EIN)). An EIN is an Employer Identification Number (also known as a Federal Tax Identification Number) and is used to uniquely identify your business to the IRS. Important Note: This is not your SSN, as you will have already entered this above.

Most businesses will need an EIN for various reasons. To find out more, read our blog post here: What is my sales tax number (EIN)?

If you don’t have an EIN, you can leave this line blank.

We’ve made it to E already, and it’s another easy one! Business Address:

This field is for your business address - this is the place where your business is officially registered. Make sure to enter all details, including the zip code, here.

This next line (F Accounting method) is often the place where handmade sellers get a little stuck as it requires a little bit of Accounting 101 knowledge.

This can either be Cash or Accrual depending on how you account for your expenses and revenue.

Cash-based accounting essentially is where you record money in and out only when the payment is actually received; accrual-based accounting records income and expenses when invoices are raised. If you aren’t sure of which method you are using, it’s a good idea to ask your accountant, as they will be able to quickly answer this question for you.

What’s the difference between accrual and cash-based accounting? →

Onward to the next question: G Did you “materially participate” in the operation of this business during (year)?

This basically asks in a strange legalese fashion if the income you have made in this year was directly from working on your business (i.e. the income wasn’t “passive” from activities like investments).

There are a couple of different criteria points to meet here, which can seem confusing, but it essentially boils down to making sure you have worked on your business for a significant period of time in the financial year (they say 500 hours or more, which is about 20 days in the year). As a handmade business, you’ll have most likely spent more than 20 days on your business, so you’ll most likely be marking this one as a Yes.

If you started or acquired this business during (year), check here: This one is fairly self-explanatory: if you started the business during this year or purchased it from someone else, make sure you check this box.

Almost there: 2 more to go. The next field (I: Did you make any payments in (year) that would require you to file Form(s) 1099?) is a little tricky, so it will need a bit of consideration.

This question essentially asks about any payments you may have made that they need to know about. Employee wage/contractor costs, nonemployee compensation, interest, rent, royalties, and pensions are the types of things that they are concerned about here.

This can also be a yes if you have paid out at least $20,000 to a single vendor in the course of the year. If you have paid a total of $20,000 in expenses but all to different vendors and have no other costs as above, then this would be No.

Also, if you have paid for contract help or paid rent and the total of this service is greater than $600, then you will need to ensure that you (or your contractor) complete 1099MISC.

There is a follow-up question to this one immediately below it and is really just designed as a big hint to make sure you know you need to file the correct forms in this case.

J: If “Yes,” did you or will you file the required Forms 1099?.

…and, like that, we are now done with the first section of the form!

Part I: Income

This is the section where you record your income for the year and is the start of the all-important (but possibly a little dry) “numbers and tallies bit” of the Schedule C Form.

Part I: Income is the section on your 1040 Schedule C Form where you record everything you have made (otherwise known as your income or revenue) for the year.

1: Gross receipts or sales

This is your total income from all sales made during the year.

2: Returns and allowances

This is the total of any refunded orders you pay back to customers. A refund is any amount you have returned to the customer for defective, damaged, and unwanted products. Include both full refunds and partial refunds here.

3: Subtract line 2 from line 1

This is really just a working number, used to ensure that you definitely aren’t including any of your refunded amounts in your total income.

4: Cost of goods sold

This will be your Cost of Goods Sold total as calculated on the second page of the form. It’s best to skip this for now and return to this box once you have the numbers you need.

5: Gross profit

Subtract your Cost of goods sold total (4) from the amount on line 3 to get your Gross Profit total.

6: Other income

This is for income not directly related to the products you sell (i.e. advertising revenue on your blog, interest on funds in business bank accounts)

7: Gross income

After adding other income (if any) on line 6 to gross profit on line 5, you’ll end up with gross income.

Part II: Expenses

The Part II: Expenses section of the Schedule C Form is the relatively “fun” bit as you’ll be listing out all of the claimable expenses you are making for this year so you can deduct this from your taxable income.

You’ll want to ensure that you aren’t claiming any material costs here, as they should be included in Part III (Cost of Goods Sold) below. For more information about why it’s important to make this distinction, you’ll want to read our blog post here: Why claiming materials as expenses is a really bad idea for a craft business →

8: Advertising

This is any form of advertising you have paid for directly linked to your business. Remember that this can also include any free products you have given to bloggers for reviews. Etsy Listing Fees can also be categorized as advertising if you wish (the only rule here is to make sure you don’t account for these also under Commissions and Fees below)

8: Car & Truck expenses

You can deduct the expenses of running your vehicles if they are essential to the running of your business. You have two ways of accounting for this expense: actual and standard mileage. If you have less than 5 vehicles and haven’t claimed in the past year using the actual method, then you can use standard mileage calculations. If you have been logging your expenses in Craftybase, you can use the actual method here.

80: Commissions and fees

This is for any money you paid to other businesses or individuals for services.

This can be fees paid for market stalls, commission paid for items you have sent out on consignment, and any fees payable for online marketplaces like Etsy.

80: Contract Labor

You’ll need to account for this expense on this line if you hire people to help run your business.

83: Depreciation

Depreciation is required for business assets with a useful life of more than a year. There is no minimum guideline on how valuable the asset needs to be before you should try to claim using this method. However a good rule of thumb is that assets below $100 in value are better expensed in supplies rather than depreciated.

87: Legal and professional services

This can include the costs of your accountants, tax preparers or any legal service.

87: Office expenses

The postage costs you incur in sending out your orders should be included here. Also, stationery and supplies for running your office (e.g. printers, ink, tape, stapler, pens). Anything likely to not be completely used up within a year should be included here.

81: Repairs and Maintenance

Any repairs on the equipment you use in the running of your business should be put here (e.g. repairs to your sewing machine).

82: Supplies (not included in Part III)

This should include any supplies you have on hand that you a) expect to use up completely within the year and b) are not directly used to produce your finished products.

These items will not be included as part of your Cost of Goods Sold, as this should only include materials you directly use in your products. Shipping labels, paper, bubble wrap, and other packaging materials should be included here.

Also, any material that you do use in the production of your products that is difficult to inventory accurately can also be included here. Examples are glue and thread: measuring the exact amounts used of both of these materials is impractical in most cases and thus can be included here.

83: Taxes and licenses

Any sales tax you pay at a state level, along with any licenses you need to pay to run your business, should be included.

Examples of expenses that can be claimed as part of this section include:

Business licenses

Estimated taxes

Federal tax

Sales tax

State tax

Property tax

Trademarks and logo fees

Software licensing and renewal fees

DBA/Fictitious Business Name one-time filing fee

Incorporation fees

Business name search fees

Copyright application and registration

Domain name search fees

Fees to draft, acquire or cancel a lease

84: Travel, meals, and entertainment

Different allowances for travel exist for certain circumstances, so it is best to check with your financial adviser first before logging and claiming these types of expenses. Generally, you need to ensure that any travel/meals you are claiming here are 100% related to the running of your business. Delivering a cake to a client would be an example of travel for business purposes, as would a trip to purchase supplies. Claiming travel for a family vacation to Florida, as you also purchased some supplies while you were there, should not be claimed.

85: Utilities

Internet and telephone bills can be included here, if they are wholly for the running of your business.

87a: Other expenses

These can include any expenses not covered in any of the other expense categories above.

Software you use to run your business can also be included here: Craftybase is business software and thus can be claimed in this allowance section.

If you haven’t included any of your online sales channel fees (PayPal / Etsy etc.) in the Commissions and fees category, then you can include them here instead.

Part III: Cost of Goods Sold (COGS)

You’ve made it to the best part: COGS! This is the part where most people filling out the Schedule C really struggle, however if you have your inventory situation sorted, it should be a (relative) piece of cake.

As part of this form, you’ll be able to claim your total material usage via your Cost of Goods Sold (Part III). If you are a business with relatively large inventory costs to produce products, this is an excellent way to ensure that your expenses can be maximized in line with the revenue you brought in during the year. More details about how you can use the COGS method can be found here: How do I calculate my Cost of Goods Sold?

33: Method used

This will usually be Cost. The cost method requires using either the FIFO, LIFO or Weighted Average method.

If you use Craftybase to help complete your Schedule C, we use the Weighted Average method to determine your totals.

34: Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

This is to see if you have changed the way you account for your inventory, as this could have an impact on your opening and closing inventory tallies. If you haven’t made any changes to how you calculate your inventory, you’ll be marking this as ‘No’.

35: Inventory at beginning of year. If different from last year’s closing inventory, attach an explanation.

If you have completed a Schedule C last year, take the number from Line 41 and enter it here. If this is your first Schedule C, this will be zero.

36: Purchases less cost of items withdrawn for personal use

This is the total of all purchases you made during the year. Ensure you remove any purchases made then removed from your inventory for personal use.

37: Cost of labor. Do not include any amounts paid to yourself

If you have employed anyone to assist you with your craft business during the year, then you would account for this cost here. Remember that this cost is mainly for official employees (that will have a W2). Contracted and casual workers should be instead factored into Part II, Line 11.

Read more about how you can factor in your internal labor costs to your pricing →

38: Materials and Supplies

This section is reserved for any materials and supplies not already included in your inventory totals above that are also not being claimed as supplies in Part II. Common usage of this section is for consumable hardware or chemicals used to produce your finished goods for sale.

39: Other Costs

This section is to provide a way of accounting for any other costs directly related to your products that don’t fit into the available categories above.

30: Add Line 35 through Line 39.

This a work-in-progress step, so you’ll want to add together what you’ve entered in Line 35 and Line 39 and write the total here.

31: Inventory at end of year.

This is the total amount of materials you have on hand at the end of the year, including materials that are already manufactured into finished products that have not been sold yet.

32: COGS

Another working step, take the total you have for 41 and subtract it from 40 to get your final Cost of Goods Sold figure. Yay!

Also don’t forget to enter this amount in Part I, Line 4.

Part IV: Information on your Vehicle

You only need to complete this section if you have claimed Line 9 (Car and Truck Expenses).

You only need to complete Part IV of the Schedule C if you have made a claim on Line 9 (Car and Truck Expenses).

43: When did you place your vehicle in service for business purposes? (month, day, year)

This is the date you started using your vehicle for business purposes.

44: Of the total number of miles you drove your vehicle during (year), enter the number of miles you used your vehicle for

Line 44a: enter the number of miles you used your vehicle for business.

Line 44b: enter the number of miles you used your vehicle to drive between work and home. If you work from home, then this will be zero.

Line 44c: enter the number of miles you drove the vehicle for non-business or commuting purposes (i.e. for your own personal use)

45: Was your vehicle available for personal use during off-duty hours?

If you also use your vehicle outside of business hours for personal use, you should check Yes here.

46: Do you (or your spouse) have another vehicle available for personal use?

If you or your spouse also use another vehicle for personal trips, then you can check Yes here.

47: Do you have evidence to support your deduction?

This asks if you have any records showing how you calculated the numbers above. Utilizing paper-based logbooks and expense-tracking applications like Craftybase are good ways of ensuring you have enough proof to support your claim.

Part V – Other Expenses

This is the area where you can account for expenses that cannot be included elsewhere on your Schedule C. Bad debts and business startup costs are some examples of expenses that can be claimed here.

It’s best to speak to your taxation adviser here to see what you can claim in this section, as it depends on your circumstances.

Line 48: Total other expenses

This is where you could claim any other business expenses. For example, your Craftybase Inventory subscription would be included here. Remember to also enter the value in Line 27a (Other expenses) above.

How do I submit my Schedule C?

Now that you know how to complete your Schedule C, you’ll most likely want to know the next steps to filing this with the IRS.

The Schedule C is an additional form (aka a “Schedule”) which is submitted alongside your regular personal 1040 tax return. This occurs on a yearly (annual) basis, and is usually due in mid April.

Schedule C Software

Completing your Schedule C form manually can be a tedious task, especially so if you are a small manufacturer, as you’ll need to be able to calculate your COGS based on your inventory and purchases. As the saying goes, there’s an app for that!

Craftybase is COGS and inventory software that allows you to easily calculate your COGS and other manufacturing expenses when filing your Schedule C. You can check it out by using their 14 day trial here to see how much easier this tax filing can be!

Conclusion

That’s it! You have now completed all the steps for completing your Schedule C for filing your taxes as a sole proprietor. Remember to also speak to your tax adviser if you are unsure of anything or require more clarification on something. Good luck and happy filing!

Disclaimer: This article is written solely as a guide and is not intended as a substitute for professional advice.

Always consult with a qualified tax professional before filing your taxes.