How to initially backdate your stock in Craftybase

As Craftybase is a perpetual inventory tracking system, it’s important to remember that all stock changes need to be accounted for in some manner so that calculations are correct and accurate.

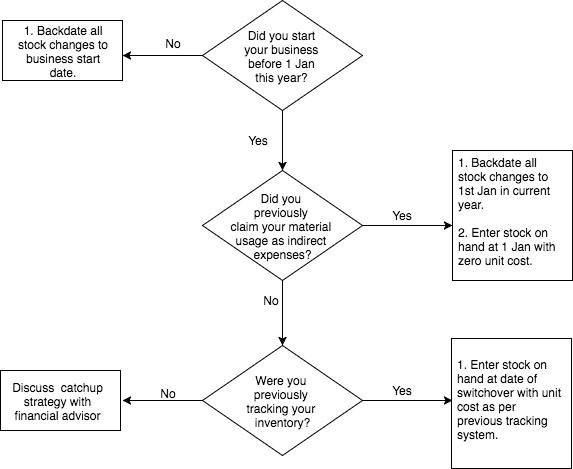

As Craftybase is a perpetual inventory tracking system, it’s important to remember that all stock changes need to be accounted for in some manner so that calculations are correct and accurate. How you go about accounting for this stock depends on a number of factors about your business and the way you have previously claimed for material usage. The three major questions you will need to think about in order to find out your strategy are:

- Are you a new (started your business during the current year) or existing business?

- How did you claim for your material usage in the last financial year?

- How have you been tracking your inventory before Craftybase?

New business

If your business is completely brand new and you have only just purchased your first batch of materials ready to begin making your products, wonderful news: you can begin using Craftybase immediately by entering in your recent purchase expenses and manufactures to account for your current stock levels - you won’t need to worry about backdating your stock and can safely skip this section.

Existing business

If your business has been trading for a while and you have already made and sold stock then you will most likely have some amount of historical records to account for in the system. To determine the extent of backdating, we’ll now need to look at into how you have previously tracked your material usage as this will determine how your historical stock is costed and entered into the system.

No previous inventory system

If you haven’t been using an inventory tracking system before this point and thus can’t bring any calculations forward, you’ll want to firstly find out how you have been claiming your material expenditure. If you’ve been claiming the full amount of all materials you have purchased in the year they were bought, then you will most likely have been claiming your materials as an indirect expense.

If you haven’t claimed your materials at all in any previous returns, then you’ll want to discuss this with your accountant to see how this situation should be best rectified before continuing with this guide.

Materials previously claimed as indirect expenses

Indirect expenses are those expenses that are incurred to operate a business as a whole and are not able to be directly associated with any particular “cost object” such as a product, order, customer or service.

Internet services or stationery are examples of costs that cannot be directly associated as it’s not possible to connect these costs with the production of your products: these are thus claimed as an indirect expense within the taxation year that the cost was incurred.

For a manufacturing business like yours, IRS guidance indicates that all material costs should be directly expensed: this means that the cost needs to be claimed using the exact amounts used in the production of your products within the year, rather than as a simple sum of purchases within the year. This usage calculation is commonly known as COGS (Cost of Goods Sold).

If you have claimed all materials purchased within the year on your last Schedule C in Part II rather than III, then you have previously claimed your materials as an indirect expense. From a taxation perspective all stock purchased before your last tax return date will now have a zero unit cost. This is essentially because your stock has been fully claimed to the tax authority - if you were to include this stock into Craftybase with a unit cost this will lead to you claiming the inventory value twice via your future returns (i.e. once for the initial purchase, and another when you finally use up the material to create your product).

Note: It is strongly recommended that you speak with your financial advisor before deciding on your approach regarding switching material claim methods as there may be some additional factors to consider to ensure you are fully in line with IRS regulations.

Example

Jacqui started her business on the 20 June 2015. In the 2015 tax year (20 June 2015 - 31 December 2015) she claimed for a total of $10,000 in material costs using the direct expensing method as she was not using an inventory tracking system to calculate COGS. During the 2016 tax year (1 Jan 2016 - 31 December 2016) she decided to switch to tracking her material costs using Craftybase.

Jacqui will need to:

- Calculate all stock purchased from 1 Jan 2016 and ensure that these costs are represented in Craftybase by adding Material Expenses with the correct unit costs.

- Enter manufactures made from 1 Jan 2016 to ensure that the correct material quantities have been deducted from inventory.

- Calculate her stock on hand on 1 Jan 2016 for each material. This can be done by counting current stock on hand and working back to Jan to remove purchases and add stock removed for manufactures. This stock on hand number should then be entered as the Starting Adjustment for each material, along with a unit cost of 0.00.

The Starting Adjustments will not have an explicit date directly logged against them - it is assumed that they represent the date you have brought forward stock into the system. For the example above, the start date would be assumed to be 1 Jan 2016.

Moving stock from a previous inventory system

If you are moving to Craftybase from a different inventory tracking system that breaks down costs at both the product and material level, the best option is to take the most recent end of year inventory values and move them across to Craftybase as your starting adjustments - you’ll then be assuming this date as your starting date within Craftybase and will not need to backdate any data before this point.

For products, it’s important that your previous system was able to accurately calculate the quantity for each item on hand on this date and the total raw material cost to produce. The same method applies to materials: you will need to be able to calculate the average unit cost of materials that you are bringing forward in the system and then enter this information as your starting adjustment.

If using this approach, remember that any manufactures of product or purchases of materials before this point should not be entered into the system as they have already been included as part of your initial adjustment value.

For both products and materials, it’s really important to set an accurate unit cost if using a starting adjustment to bring stock into the system. As Craftybase uses rolling/moving average cost calculations, your unit costs will be factored into all unit costs going forward until the stock has been fully consumed and replaced with later stock. Setting zero value or a value that is lower than it should be will therefore “dilute” your costs of production until the stock is used up, likewise setting unit costs that are higher than they should be will have the effect of your products having a larger than expected manufacture cost.

Example

John is moving to Craftybase from his old excel spreadsheet and has chosen 1 Jan 2016 as his starting date for Craftybase. For his “Orange Soap” product, he knows from his records that he had exactly 10 bars in stock on 1 Jan 2016 and that the cost of materials was $2.20 per unit.

John will need to:

- Create projects and/or variations for this products and set the Starting Adjustments for each one with the unit cost and quantity on hand at 1 Jan 2016

- Create materials and set the Starting Adjustments for each one with the calculated unit cost and quantity on hand as at 1 Jan 2016.

- Enter all material purchases from 1 Jan 2016 to the current day

- Enter all manufactures with correct material usage from 1 Jan 2016 to the current day

- Manually stocktake all products to determine the current stock on hand and compare this to the calculated stock level in Craftybase. For any differences found between the two counts, you’ll want to either create adjustments for known loss / breakage or review your adjustment history to identify any data entry issues.

Keep in mind that backdating can be done in almost any order: Craftybase is flexible enough to be able to recalculate stock and costs added at any point in time.

Please note that tax laws change frequently. This information is for educational and informational purposes only should not be construed as tax or legal advice. Please consult a licensed financial expert in your area with specific questions or concerns.