How to get a sales tax report from Etsy: The Step-by-Step Guide

Struggling with downloading the sales tax data you need from Etsy? We show you step by step how to access this important data for your handmade business.

For many Etsy sellers, navigating the complexities of managing a successful online shop includes the not-so-glamorous task of handling sales taxes.

It’s not just about crafting and selling your products anymore; it’s also about understanding the administrative and financial obligations that come with running a small business. One of these responsibilities is keeping track of sales tax.

This handy dandy step-by-step guide is here to simplify that process for you, focusing on how to easily obtain your sales tax report from Etsy. Along the way, we’ll also talk a bit about what sales tax is, how Etsy calculates and remits it so you have the full picture.

Ready to take your Etsy store to the next level?

Discover how Craftybase is the Etsy accounting software you've been missing out on: track raw materials and product stock, expenses and revenue, COGS, pricing and much more. It's your bookkeeping BFF ♥.

Just before we begin, a quick little disclaimer: I’m not your accountant. The advice given in this article is thus general and may not be suitable for your particular business situation. It’s always a good idea once you have the Etsy tax data you need to ensure that you gave a financial advisor to cross check and ensure you are lodging your taxes correctly and accurately.

So, what is sales tax?

Let’s cover a little about what sales tax is first so you know exactly what you are looking for (if you are familiar with the way that sales tax works, feel free to skip the next couple of paragraphs).

As an Etsy seller, you are required to collect sales tax from customers that are based in the same state you are.

This is known as your “nexus” - you can have more than one nexus if you have more than one presence (i.e. a warehouse in one state and a shop in another) however for many handmade sellers their one and only nexus will be their home.

As an example, a craft seller who lives in Florida and has a shop on Etsy would be required to collect sales tax from customers who are also based in Florida.

To then illustrate how nexus is extended based on your business operations: let’s say the same craft seller also had a small stock of inventory held in a warehouse in Georgia. They would then be required to collect sales tax from customers in both Florida and Georgia.

Once you understand where you have nexus, you’ll need to ensure that you are registered to change sales tax in these states. This can be done by setting up some tax rules in Etsy for your shop - you’ll choose each state in which you have nexus and then create a sales tax rate for each one. You can also create tax rates at the zip code level, if this is required for your state.

Once you have set up your state sales tax rates, your customers will be automatically charged sales tax on your behalf.

For more details on state sales tax and how it applies to Etsy sellers, please see our blog post: State Taxes: A Handmade Sellers Guide

How to create a report of your Etsy sales taxes

Now that we have a good understanding of what sales tax is and how it works with Etsy, let’s look at how to generate a report of your sales tax collected.

Unfortunately, Etsy doesn’t provide your sales tax tallies in a lovely, easy to generate and download type of report. Boo!

And, although your Etsy Stats page gives you the sales total for a time period, but it’s not always correct and up to date. In particular, it doesn’t include any shipping amounts, which is important if your state taxes require shipping to be included.

To find your sales tax report figures, you’ll need instead to navigate to a slightly hidden away area of Etsy to generate a download file which you’ll then be able to use to filter out your nexus state sales.

This means you’ll need to do a little bit of legwork to get the numbers you need for your sales tax filings.

To do this, you’ll want to follow these steps:

1. Log In to Your Etsy Seller Account

Yes, it is a little obvious, but we’ll cover anyway: The first step is to log in to your Etsy seller account. You’ll need to access your Shop Manager, which serves as your central dashboard for managing your Etsy shop.

2. Navigate to Shop Manager

You’ll want to go to your Shop Manager area. You can find this option at the top of any Etsy page.

3. Go to Settings

Once in your Shop Manager, navigate to Settings by clicking on the menu item

4. Navigate to your Options page

Now find the menu item called Options in the list that appears

5. Download Data

This is essentially your Advanced Settings area of Etsy. From here, you’ll want to click on the tab called Download Data

6. Orders Download

Scroll down to the area called Orders and select Orders from the dropdown menu called What type of CSV would you like to download?

For your quarterly sales tax return, you’ll need to download each of the months within the financial quarter as seperate files.

Alternatively, you can download all year to date sales by leaving the month dropdown blank - in this case, you’ll need to remember to to filter out all other months apart from the ones you need.

7. Download CSV

Click the Download CSV button. This will start the generation and download process to your computer. This file is called a CSV as it is essentially a text file that has been formatted with commas between each field (the acronym CSV is short for “comma separated values”). The great thing about these files is that they can be instantly opened in any spreadsheet program such as Excel, Numbers, Open Office or even Google Sheets.

8. Open in your spreadsheet

Open your file in your spreadsheet. From here, you’ll want to find the column called “Ship State” (M) and filter it to only show the nexus states you need to report on.

9. Locate your Sales Tax column

Now locate the “Sales Tax” (W). This column will show you how much in sales tax you collected from your customers on Etsy. You’ll want to sum this column to calculate your total tax for each state.

How to Remit your Etsy Sales Tax

“Remitting” means to pay or submit. When it comes to sales tax, “to remit” means to pay the state the sales tax you’ve collected from your customers. Each state has different requirements for how and when sales tax should be paid.

Generally, states require that sales tax be paid either monthly, quarterly, or annually. You’ll want to check in with your state’s tax agency to see which schedule they require.

As of 2024, Etsy now collects and remits sales tax on your behalf in the following 14 US states (and is adding more all the time, so it’s best to check in case this list is slightly out of date):

- Alabama

- Colorado

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maryland

- Michigan

- Minnesota

This means that if you sell to customers in any of these states and have your taxes set up correctly, Etsy will automatically calculate, collect and remit the tax on your behalf.

Depending on your state’s particular requirements, you may need to also submit a return to indicate the amount of sales tax you have collected and the amount that has been remitted by the third party (which in this case is Etsy).

For all other states, you’ll need to ensure that you are collecting state sales tax from customers and then file a return with the state yourself at the end of each tax period.

Introducing Craftybase: Etsy Accounting (Finally!) Made Simple

If you find the process of downloading and filtering your Etsy sales data to be tedious, time-consuming, or just downright confusing, you’re not alone.

That’s where Craftybase comes in - THE all-in-one accounting and inventory management software designed specifically for handmade businesses (which totally includes you, Etsy seller!)

Craftybase integrates directly with your Etsy shop and automatically calculates sales tax based on your location and the customer’s location. It also generates detailed sales tax reports, making it easier than ever to stay on top of your tax obligations.

In addition to managing sales tax, Craftybase offers a range of features to help you streamline and manage your Etsy shop finances, including expense tracking, profit/loss analysis, and inventory management. With Craftybase, you can spend less time on administrative tasks and more time creating and selling your products.

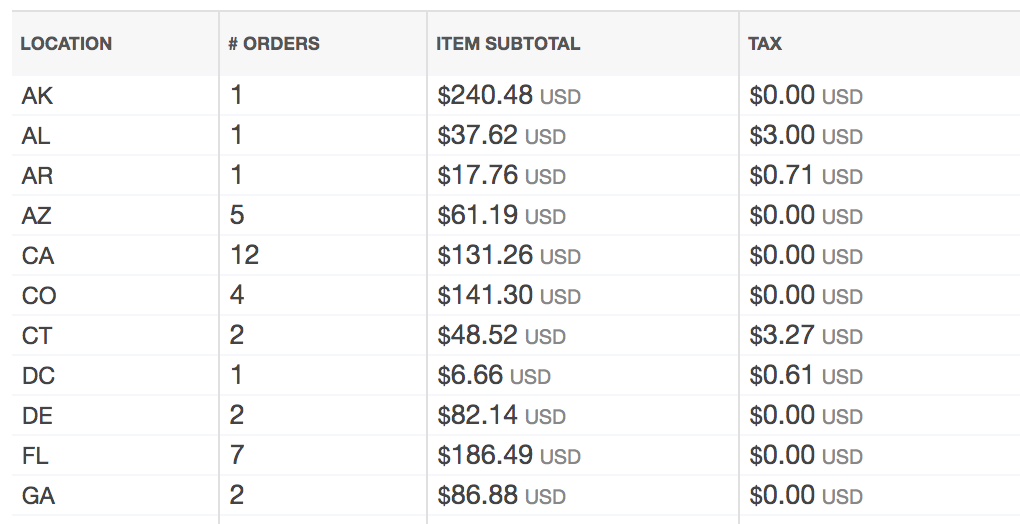

Once your data is in Craftybase, you can run powerful reports that show you exactly how much sales tax you collected from each state. You can also see a running total of how much you need to remit to each state - easy peasy!

Here’s an example of a sales tax report for Etsy that you can create at the touch of a button:

So, if you’re ready to take the headache out of sales tax, sign up for a free 14-day trial of Craftybase today.

In Conclusion

Managing your Etsy shop’s finances, from tracking sales tax to overall revenue, can initially appear overwhelming (especially if you have products to make and ship!)

Yet, with the right resources like Craftybase and a bit of know-how, this becomes a crucial aspect of operating your business efficiently.

The steps provided earlier not only guide you in accessing your sales tax report on Etsy but also highlight how Craftybase can streamline this process for you.

One final thought: being well-informed and proactive about your tax duties is fundamental to the growth and longevity of your Etsy store. Avoid the tax man audit and take control of your tax today.